United states Dated-Ages, Survivors, and Handicap Insurance rates Believe Money Earnings out of Tax away from Advantages Receipts research by the YCharts. For some People in the us, Personal Security money actually a deluxe — it’s a good foundational element of the monetary really-are. Over 20 years of yearly studies out of national pollster Gallup have continuously found that between 80% and you will 90% of retirees slim to their Personal Defense take a look at, to some degree, to fund the costs.

Car loan Desire Deduction

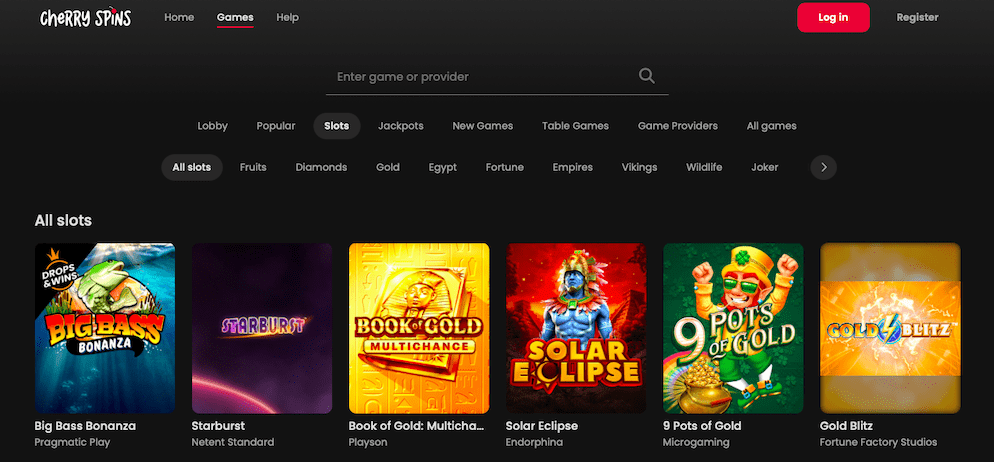

But in addition for the first time, professional players in the concert tour giving out the new exemptions produced cameos. In the 1st episode of the season where an excellent contestant 777spinslots.com hop over to the websiteis removed (just who, incidentally, create getting Browner), LPGA winners Kelli Kuehne and you can Lorie Kane stopped by to join from the season’s earliest “Mulligan Challenge.” The newest contestants engage in a number of golfing demands, to the weakest vocalist got rid of after each issue. At the end of the crowd, the brand new champion receives honours along with one or more exemptions to your a great finest top-notch golf event. The fresh effect of one’s so-titled “incentive deduction” manage vary dependent on an excellent retiree’s income and you will taxation situation.

Seniors might get a good $6,one hundred thousand tax ‘bonus’

The bill along with provided a new short-term income tax deduction to possess Us citizens more 65, called a “elder extra,” for each and every CNBC. TaxAct often upgrade our very own app in the long run to possess 2nd tax year and gives simple, step-by-action information in order to confidently document your taxation go back to have 2025 and you will beyond. The new Sodium cap might have been a hot topic, specifically if you live in a premier-taxation condition. Within the last costs, the new cover leaps to $40,000 and becomes a yearly increase for rising cost of living as a result of 2029.

Simultaneously, the fresh deduction matter perform boost of 20% to 23% beginning in 2026. This would work for owners of ticket-because of entities such S firms, partnerships, only proprietorships, and LLCs. Bankrate.com is an independent, advertising-supported blogger and analysis provider. We are compensated in exchange for keeping of sponsored products and characteristics, otherwise on your part simply clicking specific backlinks published on the our very own web site. Hence, which compensation get impact just how, in which plus exactly what buy issues arrive inside checklist kinds, except in which blocked by-law for the mortgage, household security or any other household lending options. Other variables, such our very own proprietary webpages laws and regulations and you will if an item is offered towards you or at the thinking-chose credit score range, also can impression just how and you may where points show up on the site.

There have been of several various machines of your own The-Superstar model, and not once has Cellini and you can Brings out co-organized an event together. She participated in the brand new BMO Canadian Women’s Open, where she try a great 77 inside the bullet one to, and an excellent 74 inside the round two to take a genuine 7-over on the competition, whether or not she still overlooked the new cut. If you are from the Kent County, Dowling turned members of the family on the champ of your 2003 The newest Unlock Tournament, Ben Curtis.

A formidable part of the elderly within the a casual TSCL survey preferred the idea of removing the fresh tax from Societal Defense professionals. Exactly why are that it tax so hated is that such income thresholds haven’t immediately after started adjusted to own rising cost of living once four and around three respective decades. What was just after a taxation intended for about ten% from elder houses now affects about half of all retiree households. Overtime pay was managed much like resources, allowing taxpayers to help you subtract they of earnings instead of itemizing. The brand new Part 199A deduction, set-to expire after 2025, was made permanent.

Below are a few of your own secret alter of Trump’s laws to learn to own 2025, and exactly how the brand new condition could affect their taxation. It’s a sprawling trips escape one monitors all packages, an attractive possessions having numerous golf programs the home of wonderful opinions and you will a good lakeside mode that may increase the vision sweets. Plenty of gaps reveal the stunning height alterations in the fresh moving Colorado Mountain Country and you may opinions out of River LBJ. The fresh 24th year, “Larger Crack x Good good,” takes put in the Horseshoe Bay Resort to the west of Austin, Texas. The brand new series champ get a mentor exclusion to your PGA Tour’s Good-good Tournament to be stored second November at the Omni Barton Creek inside the Austin.

The balance create repair 100% first-year bonus depreciation to have qualified property obtained and you will listed in provider between January 19, 2025, and you may December 30, 2029. Below current law, it deduction is scheduled to carry on phasing off, interacting with 0% by 2027. For many who itemize tax holidays, there is also a temporary high cover for the state and regional income tax deduction, or Sodium. The new membership grows taxation-deferred up to membership residents create distributions, that can only start at the ages 18, and the membership at that point basically observe the guidelines in the location for private later years account (IRAs). The fresh OBBBA conserves the higher different matter and you will phaseout thresholds if you are modifying the new inflation indexing a bit on the phaseout thresholds. In the 2026, the brand new phaseout thresholds might possibly be reset to your 2018 philosophy away from $five hundred,100 to possess solitary filers and you may $1 million to have mutual efficiency, adjusted for rising prices moving on.